The Treasury Department has launched a full audit of roughly $9 billion in preference-based contracts across Treasury and its bureaus to hunt down fraud and protect taxpayer dollars. The review targets possible abuses of the Small Business Administration’s 8(a) Business Development Program and other preference initiatives, and it follows the suspension and termination of contracts tied to ATI Government Solutions amid allegations involving more than $253 million. The action signals a tighter stance on procurement, tougher oversight, and new reporting requirements for service contracts.

This audit will comb through task orders and contracts awarded under programs that give certain businesses procurement advantages, with the goal of spotting pass-through schemes and non-performance. Officials are especially focused on arrangements where an eligible small business collects fees despite doing little of the real work, while larger firms do most of the contracting. That kind of setup can hide waste and deny honest small businesses real opportunity.

The Treasury’s review follows immediate steps taken regarding ATI Government Solutions, where the department suspended and then terminated contracts amid serious allegations. Those allegations involve more than $253 million in previously issued awards and triggered a broader look at how preference programs were applied.

Most of the contracts under review were awarded as part of the Biden administration’s equity in procurement initiative, which expanded set-aside programs across agencies without what critics say was adequate scrutiny. From a Republican perspective, that expansion invited abuse and reduced accountability, so the new audit is a necessary course correction. The goal is to ensure small-business preferences serve genuine small firms, not shell arrangements that funnel dollars away from taxpayers.

The U.S. Department of the Treasury today announced a comprehensive audit of all contracts and task orders awarded under preference-based contracting, totaling approximately $9 billion in contract value across Treasury and its bureaus. The audit will examine potential misuse of…

— Treasury Department (@USTreasury) November 7, 2025

Treasury leaders have ordered acquisition teams to demand detailed staffing plans and to collect monthly workforce performance reports on service contracts. Those tools are practical and direct ways to notice when a contract team is not delivering or when work is being shifted off-contract to obscure the true performer. Consistent, documented oversight will make it harder for bad actors to hide behind paperwork.

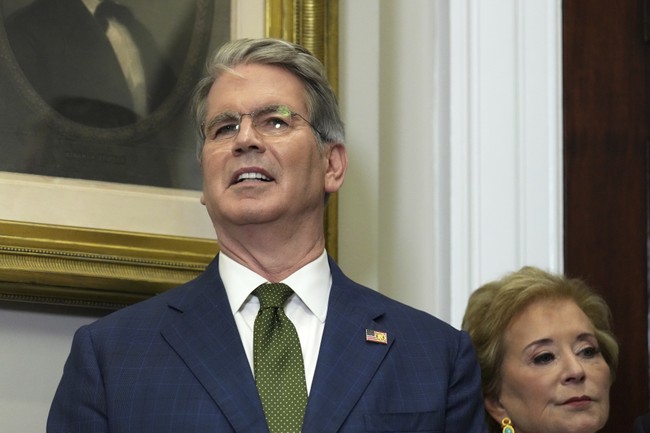

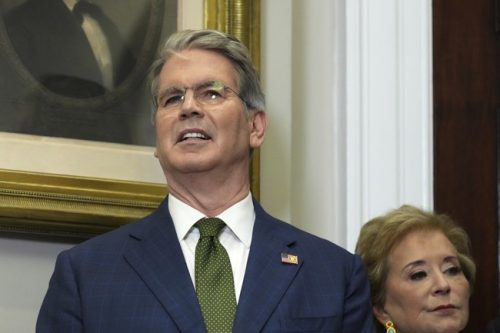

“President Trump has directed his administration to eliminate fraud and waste wherever it occurs, ensuring that each taxpayer dollar is spent as intended,” said Treasury Secretary Scott Bessent. “Treasury will not tolerate fraudulent misuse of federal contracting programs. These initiatives must benefit legitimate small businesses that deliver measurable value to the government and the public.” That public message ties audit work to a broader commitment from the administration to protect the budget and honest contractors.

Republican critics point out that the rapid growth of equity and diversity-focused contracting under the prior administration created a softer procurement environment that invited creative accounting and pass-through deals. When preference programs expand without parallel enforcement measures, the door opens for opportunistic behavior that hurts both taxpayers and the small businesses these programs were meant to help. The audit aims to restore balance by pairing preference with verification.

Kelly Loeffler made the SBA’s position clear in her comments on the matter: “During the Biden Administration, federal contracting set-aside programs proliferated without scrutiny or oversight – which is why the SBA launched a full audit of the 8(a) Business Development Program earlier this year to examine contracts across every agency,” said Kelly Loeffler, Administrator of the U.S. Small Business Administration. Her statement frames the SBA’s audit as part of a coordinated effort to close loopholes and enforce program rules.

Beyond audits, the practical steps Treasury is imposing should tighten how contracts are managed day to day. Requiring proof of who is actually doing the work and measuring monthly performance creates a paper trail that investigators can follow, which makes it harder to conceal pass-throughs. That kind of transparency benefits honest vendors and gives taxpayers a clearer accounting of where money goes.

For Congress and watchdogs, the Treasury audit offers data that could reshape oversight and contracting rules going forward. If the review finds systemic problems, lawmakers may push for statutory changes to close loopholes and strengthen penalties for misuse of preference programs. From a Republican vantage point, the focus should be on ensuring that federal procurement rewards legitimate competition and real value rather than policy signaling.

The audit is not just an exercise in blame; it’s a chance to restore confidence in federal contracting and to ensure set-asides actually support small businesses that perform. When procurement rewards real capability rather than theater, the government gets better services and taxpayers get better value. This effort also highlights the need for continued vigilance whenever procurement programs are expanded quickly.

Editor’s Note: The Schumer Shutdown is here. Rather than put the American people first, Chuck Schumer and the radical Democrats forced a government shutdown for healthcare for illegals. They own this.

Help us continue to report the truth about the Schumer Shutdown. Use promo code POTUS47 to get 74% off your VIP membership.