September’s consumer price report delivered a surprise: headline inflation eased to 3 percent and monthly gains were smaller than analysts forecast, while wage measures showed strength. The delayed release, hampered by the ongoing government shutdown, drew praise from the White House and top economic advisers and raised fresh warnings about the political cost of keeping the government closed. Officials said the numbers reduce pressure on the Federal Reserve and bolster the case that Trump-era policies are lowering costs for American families. Republicans are using the report to argue that the Schumer Shutdown risks undoing that progress.

For everyday Americans this report is welcome relief: a 0.3 percent monthly rise that left the annual CPI at 3 percent. The Rapid Response X account summed up the market reaction by saying “smashing economists’ expectations,” and many markets and businesses reacted to the better-than-feared figures. Lower readings like these ease the squeeze on household budgets and give policymakers room to consider rate moves without panicking markets. It is also a reminder that headline inflation can fall even while uncertainty persists.

Inflation in September smashes economists' expectations AGAIN — with prices holding steady and wages beating inflation.

President Donald J. Trump's Golden Age is here to stay. pic.twitter.com/Gz0sSnAtie

— Rapid Response 47 (@RapidResponse47) October 24, 2025

Prices that people pay for a variety of goods and services rose less than expected in September, according to a Bureau of Labor Statistics report Friday that keeps the door wide open for another interest rate cut next week.

The consumer price index showed a 0.3% increase on the month, putting the annual inflation rate at 3%. Economists surveyed by Dow Jones had been looking for respective readings of 0.4% and 3.1%. The annual rate reflected a 0.1 percentage point uptick from August.

Excluding food and energy, core CPI showed a 0.2% monthly gain and an annual rate also at 3%, compared to respective estimates of 0.3% and 3.1%, the latter being unchanged from a month ago. Core CPI on a monthly basis had posted 0.3% gains in both July and August.

The CPI reading is the only official economic data allowed to be released during the government shutdown.

The data were released late because of what Republicans are calling the Schumer Shutdown, and officials warned that continued closure could prevent next month’s CPI report from being produced. Surveyors cannot deploy to the field while parts of the government remain closed, which means the October figure may not arrive on schedule in November. That gap would leave markets and policymakers operating with less reliable information at a delicate moment for monetary policy. Republicans argue that it is reckless to jeopardize economic transparency for political theater.

“Today’s new Consumer Price Index reveals inflation smashed market expectations once again in September — with prices holding steady and wages beating inflation as President Donald J. Trump ushers America into a new Golden Age.”

Unfortunately, the Democrat Shutdown risks grinding that progress to a halt. Because surveyors cannot deploy to the field, the White House has learned there will likely NOT be an inflation release next month for the first time in history — depriving policymakers and markets of critical data and risking economic calamity.

Here’s what else you need to know:

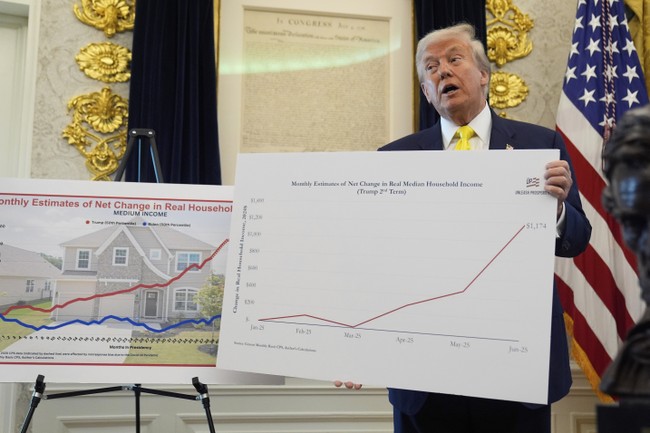

- Inflation has remained steady since President Trump took office, averaging just 2.5% — compared to an average of 5% under Biden.

- Real private sector wages are on track to rise by $1,151 (+1.8%) since President Trump took office — welcome relief after private sector wages declined by nearly $3,000 (-4.5%) under Biden.

- Gasoline prices are on track for an annualized drop of 7.5% since President Trump took office — reversing an average annual increase of 7.7% under Biden.

- Gas prices have approached their lowest average levels in more than four years.

- The 12-month change in overall shelter costs is at its lowest level in four years.

- Costs are down for motor vehicle insurance, used cars and trucks, communication commodities, propane, fresh fruits, nonprescription drugs, butter, adult apparel, and a host of other items — while egg prices are down 23.7% since President Trump took office.

- Bloomberg’s Chris Anstey: “These readings will also bolster the Trump administration’s argument that inflation is under control and tariffs aren’t triggering a cost-of-living surge.”

Under President Trump, America is back — but inflation is not.

White House Press Secretary Karoline Leavitt echoed that line and warned the shutdown will harm markets and families if it continues. She said, “Inflation came in below market expectations in September thanks to President Trump’s economic agenda. This is good news for American families, and it’s a shame the Democrats are using them as ‘leverage’ to fund health care for illegal aliens. Democrats choosing to keep the government closed will likely result in no October inflation report, which will leave businesses, markets, families, and the Federal Reserve in disarray.” The statement framed the numbers as proof that current policies are working.

Acting chair of the Council of Economic Advisers Pierre Yared discussed the figures on Newsmax and emphasized the surprise nature of the print. “These numbers are terrific,” Yared said. “The headline inflation came in not only below expectation, with around 48 Bloomberg economists getting it wrong, the CPI inflation rate came in below last month’s rate.” His point was that forecasters had overestimated short-term price pressure and that the trend is moving in the right direction.

NEC Director Kevin Hassett also weighed in, noting special factors that distorted some components of the monthly changes. “There are some special factors that drove the prices up,” Hassett said. “There was a big refinery shutdown that made the price of gas go up a lot, and that’s going to be a big negative for October. We know gas prices have gone way down. Our expectation is that inflation is decelerating, and that’ll take all the pressure off the Fed to keep on the path that they’re on.”

Bloomberg commentary and other market observers agreed that tariffs and other policy shifts have not triggered a sustained surge in living costs. Analysts pointed to falling gas and shelter inflation, along with gains in real wages, as the data that justify a calmer monetary stance. That view underpins Republican calls for continuing the economic agenda that they credit with stabilizing prices.

If the Schumer Shutdown persists, October’s CPI may not be measured on schedule, and that gap would create real uncertainty for consumers and investors heading into the holiday season. The administration and allies insisted the shutdown is unnecessary and that restoring full government operations should be a priority to keep economic data flowing. The political fight over funding is now squarely tied to whether routine economic reporting can continue.

Editor’s Note: The Schumer Shutdown is here. Rather than put the American people first, Chuck Schumer and the radical Democrats forced a government shutdown for healthcare for illegals. They own this.